-

11-09-2012 11:27 AM #1

Gold Member

- Ngày tham gia

- Oct 2009

- Bài viết

- 1,925

- Được cám ơn 617 lần trong 428 bài gởi

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Tập hợp những bài viết đỉnh về phần mềm phân tích kỹ thuật MetaStock

Bạn nào có bài gì hay post lên nhé

-

11-09-2012 11:29 AM #2

Gold Member

- Ngày tham gia

- Oct 2009

- Bài viết

- 1,925

- Được cám ơn 617 lần trong 428 bài gởi

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Vài hướng dẫn khá thú vị về phần mềm phân tích kỹ thuật MetaStock

http://www.google.com.vn/url?sa=t&rc...ExAa5NFTFELDCw

-

12-09-2012 08:09 AM #3

Member

- Ngày tham gia

- Oct 2003

- Bài viết

- 365

- Được cám ơn 215 lần trong 148 bài gởi

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm phân tích kỹ thuật MetaStock

RSI with EMA Strategy

Contributed by Robert W. Colby, CMT

In my 39 years of actual technical research experience, I have tested many of the analytical tools available. (Okay, so in my early years, I was testing different kinds of graph paper, rulers, and pencils). More than 22 years ago, I reviewed more than a dozen technical software programs for PC Magazine, Special Issue, April 15, 1986, Volume 5, Number 7. MetaStock was new then, practically a startup, but it stood out above the rest, and so I selected it as “Editors’ Choice”. 17 years later, I selected MetaStock software again for exclusive use researching for my 820-page book, The Encyclopedia of Technical Market Indicators, Second Edition, McGraw-Hill Publishing, 2003. I selected MetaStock for its wide-range of powerful capabilities, its flexibility, its ease of use, and its affordability.

While doing research for my book, I ran hundreds of optimizations, back tests, and forward tests. Since then, I since have run thousands more. It is my impression that these very powerful tools are widely misunderstood and underutilized by the great majority of investors and traders. In 2005, I gave an interview to TradingMarkets.com where I demonstrated an optimized version of a robust and very popular technical indicator, RSI 3 (buy below 30, sell above 70), combined with a long-term EMA filter of 330 days, for a simple mechanical trading system that offers moderately good performance with no subjective judgment. RSI alone is a relatively weak performer, but the addition of an EMA to filter the trades is the key to greater consistency of results. Which EMA? Optimize over past actual history to find out. The full MetaStock code is shown below. The chart shows the forward tested, real-time simulated performance of this same system applied to the S&P 500 continuous futures contract since January 3, 2007. Since the Buy Long signal on January 3, 2007, this RSI/EMA system is up 8.60%, significantly outperforming Buy & Hold (which is down 12.00%) by 2060 basis points. Of 24 signals, 66.67% were profitable, with 16 winners and 8 losers. See chart for the Cumulative Equity graphed against the raw closing price data.

The purpose of this demonstration is not to recommend any specific trading system. RSI, though very popular, is not the best indicator, and it certainly is possible to develop much better trading systems than the one shown in this example. My purpose is to show that by using powerful analytical software, such as MetaStock, combining common known indicators, optimizing parameters, back testing, and forward testing, it is possible to develop a trading system that can outperform going forward. More power to you!

RSI/EMA System Code

Enter long:

(RSI(C,opt1)<50-opt2

AND

C>Ref(Mov(C,opt3,E),-1))

AND Year()>2006

Close long:

(RSI(C,opt1)>50+opt2

OR

C<Ref(Mov(C,opt3,E),-1))

AND Year()>2006

Enter short:

(RSI(C,opt1)>50+opt2

AND

C<Ref(Mov(C,opt3,E),-1))

AND Year()>2006

Close short:

(RSI(C,opt1)<50-opt2

OR

C>Ref(Mov(C,opt3,E),-1))

AND Year()>2006

OPT1

Range: From 3 to 3 by 1

Current value: 3

OPT2

Range: From 20 to 20 by 1

Current value: 20

OPT3

Range: From 330 to 330 by 1

Current value: 330

Initial equity - 1424.8

Positions - Long and short

Entry trade price - Close

Entry trade delay - 0

Exit trade price - Close

Exit trade delay - 0

Entry commission - 0%

Exit commission - 0%

Interest rate - 0%

Margin req. - 100%

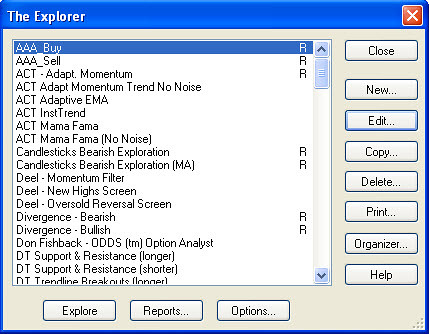

How can I run an Exploration to find Relative Strength Comparative values?

To construct a Comparative Relative Strength Exploration in MetaStock, please use the following steps below for your version of MetaStock:

MetaStock 8 – 10.1

With the newer versions of MetaStock this can now be done with the Security Data Function.

To construct a Comparative Relative Strength Exploration in MetaStock for Windows version 8.01 perform the following steps (This example will reference online data from Reuters DataLink, specifically the S&P 500):

Open the Tools menu

Select the Explorer

Click New

Name it Relative Strength Comparative

Select the Column A tab:

Enter the following formula: C/Security(“ONLINE:.SPX”,C)

Click OK

Run the Exploration

The results are displayed in the exploration report. They can be ranked by selecting the column header.

MetaStock 6.52 – 7.X

In versions of MetaStock for Windows prior to 8.01, this had to be done using the “P” variable and required you to open the chart of the index to be compared against.

To construct a Comparative Relative Strength Exploration in MetaStock for Windows, prior to version 8.01, perform the following steps:

Open the chart for the desired index.

Click to select the price plot (This will place small boxes on the prices to designate that the price has been selected)

Create a custom exploration for the Relative Strength Comparative

Open the Tools menu

Select the Explorer

Click New

Name it Relative Strength Comparative

Select the Column A tab

Enter the following formula; C/P (Note: The P variable references the selected indicator in the active chart which would be the close)

Click OK

Run the Exploration

The results are displayed in the exploration report. They can be ranked by selecting the column header.

The Rahul Mohindar Oscillator

What sets MetaStock apart? Well, succinctly stated from the unbiased perspective of the MetaStock sales team; “a lot”. MetaStock feature after MetaStock feature has become the industry standard. Data, charting, back testing, speed and power of , the Explorer, the Expert Advisor, user defined analytics, 150 indicators and line studies, performance systems, unsurpassed support that is free for life… the list goes on and on. One of the most popular, if not revolutionary, features has been the legendary Rahul Mohindar Oscillator (RMO).

The RMO was developed by the famed trader and CNN and CNBC India analyst Rahul Mohindar. It took Asia by storm and now, as released by MetaStock, has become a worldwide phenomenon.

The RMO uses five indicators to detect the correct overall trends in financial markets. It uses multiple criteria to identify a trading opportunity – and provides rules for getting out of a trade; working across any timeframe for a wide variety of securities including stocks, commodities and FOREX.

No system is “one size fits all” or can claim the merits of a crystal ball but the RMO has been successful for legions of users giving them high levels of confidence in their trades by getting them in with the primary trend while keeping a close eye on the swing in the market and market sentiment.

As one customer told me, “The RMO system is truly a winner…the RMO Buy/Sell signals have been fantastic.”

What sets MetaStock apart? The RMO has been a very powerful tool for many, many users and is exclusive to MetaStock. If you are looking for a little more of a trading edge; check out the RMO in MetaStock 10.

Call (800) 587-8014 if you have questions about how MetaStock will improve your trading odds using the RMO or any of our 26 trading systems and unparalleled tools.

Contributed by Greg Allred

-

12-09-2012 08:15 AM #4

Member

- Ngày tham gia

- Oct 2003

- Bài viết

- 365

- Được cám ơn 215 lần trong 148 bài gởi

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm phân tích kỹ thuật MetaStock

Combining Relative Strength and Other Technical Indicators

Contributed by Michael Carr

Technical analysts have spent decades creating formulas designed to give them a trading edge. Many are based upon the principle that changes in momentum will occur before changes in price trend, in other words technicians are saying that Relative Strength (RS) in a stock’s past performance is a good indicator of future price appreciation. Examples of technical indicators include stochastics, the moving average convergence-divergence indicator (MACD), and the Relative Strength Index (RSI).

RSI was introduced to the world by Welles Wilder in 1978. It is among the most popular momentum oscillators used by technicians, and is a very useful component in many trading strategies. The RSI compares the strength of a stock's recent upside movement to the magnitude of its recent losses and provides that information as a single value that ranges from 0 to 100. However, it is not a measure of comparative RS because it does not take into account the performance of other stocks or the market itself. The theory behind the RSI is that it will identify those times when a stock has moved too far, too fast and is due to exhibit mean reverting behavior causing a reversal of the current trend. It is intended to spot tops and bottoms rather than find stocks that are starting to move higher for an extended period of time, as RS seeks to do.

MACD measures the difference between a short-term and long-term moving average of closing prices. The longer moving average is subtracted from the shorter moving average. The theory behind this indicator is that this calculation of a stock’s momentum will show when prices are changing directions. A positive value of MACD indicates that the short-term MA is trading above the long-term MA. A negative MACD indicates the opposite. If MACD is positive and rising, then the gap between the two MAs is widening, which means the rate of change of the short-term MA is higher than the rate of change for the long-term MA. This should lead to higher prices for the stock. If MACD is negative and declining further, then downward momentum is accelerating, and lower prices are to be expected.

The MACD indicator has been adapted as a measure of RS by Christopher Hendrix, CMT.ii Hendrix substitutes a RS calculation for price into the traditional MACD formula and creates a Momentum of Comparative Strength (MoCS) formula:

MoCS = (12-period EMA of (Stock/S&P 500)) – (26-period EMA (Stock/S&P 500))

where EMA represents an exponential moving average

Stock represents the closing price of the stock being evaluated

S&P 500 represents the close of the S&P 500 Index

An exponential moving average (EMA) is used by some market technicians to reduce the time lag introduced with simple moving averages. When using a moving average to smooth the data and help identify the trend, some delay is introduced into the price series. EMA's reduce the lag by overweighting the importance of more recent prices, with the amount of overweighting determined by the specified period of the EMA. Shorter period EMAs overweight the most recent price more than longer period EMAs. In the MoCS formula, the most recent close accounts for 15 percent of the value of the 12-period EMA, and the 26-period EMA derives about 7.5 percent of its value from the most current price. Because it puts more weight on recent prices, an EMA will react quicker to recent price changes than a simple moving average which equally weights all data points.

Trading signals are generated when a 9-period EMA of the MoCS crosses above or below the current value of the MoCS. An example is shown in Figure 1. Buys are signified when the solid line is above the dotted line, sell signals are the reverse. The advantage of MoCS is that it compares the movement of a stock to the overall market but allows the investor to apply a RS strategy to a single security, rather than requiring that an investment universe be rank ordered and sorted into percentiles. The chart shows there are clear buy and sell signals based only upon the behavior of this stock compared to the market.

Figure 1: Modifying the formula of the well-known MACD technical indicator to measure RS allows an investor to see clear buy and sell signals for an individual security. The Momentum of Comparative Strength (MoCS) indicator is shown in the bottom panel of this figure. In this case, a buy signal occurs when the solid line crosses above the dashed line, and a sell occurs when the solid line falls below the dashed line.

As can be seen in Figure 1, MoCS offers timely signals. Its sell signals are usually closer to the top than the signals given by other indicators. Traditional oscillators give a large number of false signals. Using weekly settings for MoCS provides very few signals, and even fewer losing trades.

This technique can be applied to any technical indicator by adapting the formula to use a RS ratio instead of the stock’s closing price. It is a highly adaptable strategy which can employ RSI, or stochastics, for example, instead of using MACD. Alternatively, investors can change the time periods for MACD to generate a greater or lesser number of signals.

Wilder, J. Welles, New Concepts in Technical Trading Systems, Trend Research, 1978.

ii ‘It’s Like Spreading Peanut Butter & Jelly,’ Christopher P. Hendrix, CMT, SFO Magazine, November 2006.

Michael Carr has been trading for more than twenty years and is a Chartered Market Technician (CMT). Carr began researching relative strength trading more than a decade ago and after retiring from the U.S. Air Force as a Lieutenant Colonel, he became a full-time relative strength investor. He is the editor of the Market Technicians Association (MTA) monthly newsletter, Technically Speaking, and associate editor of the MTA's scholarly publication, Journal of Technical . Carr also serves on the board of directors of the MTA Educational Foundation. His work has been published in SFO, Futures, TRADERS , and Working Money. He is also the author of Smarter Investing in Any Economy: The Definitive Guide to Relative Strength Investing (www.w-apublishing.com), from which this article is extracted.

Back to top

Support Tip

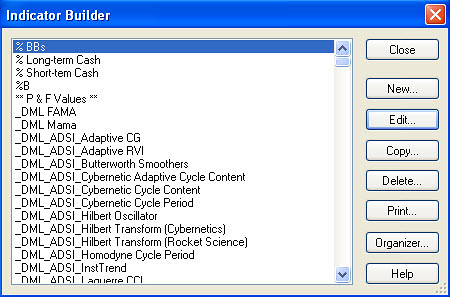

How can I backup my formulas? (Indicators, Experts, Explorations & System Tests)

Contributed by Equis Support

All of your formulas can be quickly backed up by the following procedure:

Open MetaStock

Click Tools | Indicator Builder

Click Organizer

Click Export

For each of the formula based tools, select the items to be backed up.

Specify the location you wish to export the files to. You can password protect them here, but we advise you not to unless you are distributing them to other people you do not want to have access to the formula code.

Click OK

This will back up the selected formula files in the destination location you specify. Although safe guards are put into place to in MetaStock to mitigate loss of data, backing up your work provides you with additional peace of mind; therefore we recommend that you regularly back up your work.

Back to top

MetaStock Features

MetaStock Scanning

Contributed by David Derricott

One of the most commonly used features in MetaStock is the ability to scan. This is a very powerful and useful part of the program. It’s a great way to find securities you want to trade, will help you decide when to trade, and if you should stay out of the market. A very simple and easy scan you can create using MetaStock is scanning for buy and sell signals when a moving average crosses above or below the price bar over the last 20 days.

Another great part of the scanner is the ability to make the scans as simple or as complex as you would like. MetaStock has about 40-50 pre-programmed scans included in the software. You can use historical data to back test these scans to see how they perform over any given period of time. Once you have determined which scans work best for you, you can apply these to your trading portfolio. MetaStock provides data for 30 years on daily charts and one year on intraday charts. The scanning capabilities within MetaStock work well for both end of day traders and real time traders. It doesn’t matter if you trade stocks, options, futures, or forex the program will work great with all markets.

If you would like assistance with setting these scans you can contact our support team. We offer world class support and all our representatives are very knowledgeable and will spend as much time as needed to assist you with your questions and problems. In the past year MetaStock support representatives have answered 85% of their calls in two minutes or less. You can contact the support department via phone, email, or online using our support chat feature.

For more information regarding the scanning feature found within MetaStock, please contact David Derricott directly at 800.587.8012 or via email at david.derricott@thomsonreuters.com.

-

12-09-2012 10:42 AM #5

Senior Member

- Ngày tham gia

- Aug 2010

- Bài viết

- 648

- Được cám ơn 325 lần trong 218 bài gởi

Những series bài hay về phần mềm PTKT phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm PTKT phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm PTKT phân tích kỹ thuật MetaStock

Bollinger Band Basics

Contributed by John Bollinger

Bollinger Bands are available on MetaStock and most charting software. They have become popular primarily because they answer a question every investor needs to know: Are prices high or low?

What are Bollinger Bands? They are curves drawn in and around the price structure on a chart providing a relative definition of high and low. To wit: Prices near the upper band are high, prices near the lower band are low.

The base of the bands is a moving average that is descriptive of the intermediate-term trend. This average is known as the middle band and its default length is 20 periods. The width of the bands is determined by a measure of volatility called standard deviation. The data for the volatility calculation is the same data that was used for the moving average. The upper and lower bands are drawn at a default distance of two standard deviations from the average.

These are the standard Bollinger Band formulas

Upper band = Middle band + 2 standard deviations

Middle band = 20-period moving average

Lower band = Middle band - 2 standard deviations

Here is an example of Bollinger Bands applied to a chart:

To teach you how to use Bollinger Bands effectively would take a book, however the following rules serve as a good beginning point.

15 Basic Rules for Using Bollinger Bands

1. Bollinger Bands provide a relative definition of high and low.

2. That relative definition can be used to compare price action and indicator action to arrive at rigorous buy and sell decisions.

3. Appropriate indicators can be derived from momentum, volume, sentiment, open interest, inter-market data, etc.

4. Volatility and trend already have been deployed in the construction of Bollinger Bands, so their use for confirmation of price action is not recommended.

5. The indicators used for confirmation should not be directly related to one another. Two indicators from the same category do not increase confirmation. Avoid colinearity.

6. Bollinger Bands can be used to clarify pure price patterns such as M-type tops and W-type bottoms, momentum shifts, etc.

7. Price can, and does, walk up the upper Bollinger Band and down the lower Bollinger Band.

8. Closes outside the Bollinger Bands can be continuation signals, not reversal signals--as is demonstrated by the use of Bollinger Bands in some very successful volatility-breakout systems.

9. The default parameters of 20 periods for the moving average and standard deviation calculations, and two standard deviations for the bandwidth are just that, defaults. The actual parameters needed for any given market/task may be different.

10. The average deployed should not be the best one for crossover signals. Rather, it should be descriptive of the intermediate-term trend.

11. If the average is lengthened the number of standard deviations needs to be increased simultaneously; from 2 at 20 periods, to 2.1 at 50 periods. Likewise, if the average is shortened the number of standard deviations should be reduced; from 2 at 20 periods, to 1.9 at 10 periods.

12. Bollinger Bands are based upon a simple moving average. This is because a simple moving average is used in the standard deviation calculation and we wish to be logically consistent.

13. Be careful about making statistical assumptions based on the use of the standard deviation calculation in the construction of the bands. The sample size in most deployments of Bollinger Bands is too small for statistical significance and the distributions involved are rarely normal.

14. Indicators can be normalized with %b, eliminating fixed thresholds in the process.

15. Finally, tags of the bands are just that, tags not signals. A tag of the upper Bollinger Band is NOT in-and-of-itself a sell signal. A tag of the lower Bollinger Band is NOT in-and-of-itself a buy signal.

These rules outline the basic guidelines for using Bollinger Bands. For a more comprehensive understanding of the bands, I suggest that you read “Bollinger On Bollinger Bands”. The book starts with the basics, builds to the complex and teaches the technical process including which indicators to use and how to read charts.

The Bollinger Band Tool Kit for MetaStock provides easy to use implementations of all the trading systems and indicators from the book.

John Bollinger, CFA, CMT is probably best known for his Bollinger Bands, which have been widely accepted and integrated into most of the analytical software currently in use. He is the president of Bollinger Capital Management, a money management firm, and publishes a monthly newsletter, The Capital Growth Letter. He has eight financial websites: www.BollingerBands.com, www.BollingerOnBollingerBands.com, www.EquityTrader.com, www.FundsTrader.com, www.GroupPower.com, www.MarketTechnician.com, www.PatternPower.com and now a forex site, www.BBForex.com.

Support Tip

How can I find and delete local securities that are no longer trading?

Contributed by Equis Support

A good technical trader regularly cleans up the symbol lists they use for trading. Creating an exploration to identify securities that are no longer trading takes just a moment and saves you time in the future. The following method identifies securities that are no longer trading and provides a way to easily remove them from your lists.

Create a new exploration with the following formula:

Col A name: month, Col A formula: Month()

Col B name: day, Col B formula: DayOfMonth()

Col C name: year, Col C formula: Year()

Filter ( (Year() < 2009) OR (Month() < 2) )

Run the exploration. The results will be the securities that are no longer trading. Select all of the results and delete them.

Below is a step by step process of how to create this exploration:

1. Open MetaStock

2. Open the Tools menu

3. Select The Explorer

4. Click New

5. Name the new exploration (we suggest "no longer trading")

6. In Column A, type in the following:

- name: month

- formula: Month()

7. In Column B, type in the following:

- name: day

- formula: DayOfMonth()

8. In Column C, type in the following:

- name: year

- formula: Year()

9. In the filter column, type in the following

- ( (Year() < 2009) OR (Month() < 2) )

- Note: you'll want to change the '2009' and '2' to the current year and month before you run this exploration.

10. Click OK

11. Click Explore

12. Add your data folders to the Select Securities dialog

13. Click OK

14. Click Reports when complete and select the Results tab

15. Select the first security, hold down the Shift key and click on the last security

16. Right click on the selected securities

17. Select delete securities

MetaStock Features

The RMO ATM

Contributed by Devin Ekberg

With the recent highly turbulent financial markets, it is extremely important to consider volatility and volume as part of a trader’s technical . Volatility is defined as the relative rate at which the price of a security moves up or down, and is calculated using a statistical method of standard deviation. Volatility can be a trader’s best friend or worst enemy depending on how his/her accounts for it.

Most traders expect to make money quickly and easily; knowing when markets are dormant, active, or hyperactive can mean the difference between a fast moving profit and a slow churning loss. The RMO ATM add-on for MetaStock contains many templates and strategies for measuring volatility, including a set of indicators called “Zone Detector” and “Zone Fill” (See Figure 1 below).

The Zone Detector (dark green line) ranges from 0-1 indicating a period of sufficient activity (1) or insufficient activity (0). A value of one indicates enough activity is present to move the price action in either direction quickly and efficiently. When the value is zero, a trader is more likely to experience a sideways or choppy movement in price action.

The Zone Fill (light green histogram) is a secondary measure suggesting the activity is not only favorable for a trade, but also considered “hyperactive” and a trader can feel more comfortable with a larger position or more aggressive profit target.

These two indicators can be used along with the other strategies in the RMO ATM add-on as a filter for executing only the trades with the highest probability for success. Imagine a mechanism keeping one’s money out of the capital-draining choppy markets, and only in efficiently trending markets.

The RMO ATM was created by Rahul Mohindar, who is best known for his RMO Trade Model template in MetaStock 10. I have many clients who have given superb feedback in these strategies even in the most unpredictable financial markets of our lifetimes. If you have any questions about this product or others, you may contact me anytime for more detailed information. Until then, I hope your trading is successful.Last edited by tradingpro8x; 18-09-2012 at 08:36 AM.

-

12-09-2012 02:27 PM #6

Senior Member

- Ngày tham gia

- Aug 2010

- Bài viết

- 648

- Được cám ơn 325 lần trong 218 bài gởi

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm PTKT phân tích kỹ thuật MetaStock

A New Look At A Decades-Old Tool

Contributed by Don Fishback

There's been a lot of talk lately about models, probability and statistics. The reason is manifold, but it all distills down to what's going on in the banking and financial sector. You see, nearly every major decision in national and global-scale finance - whether it was the ability of a group of borrowers to pay back loans, the amount of capital banks were required to keep, the amount of collateral required to provide credit default insurance, or the value of certain derivatives - is based on a probability model.

A contemporaneous example is the so-called "bank stress test". Regulators disclosed the methodology for the stress test in late April. In that disclosure, they said, " of [commercial and industrial] loan loss projections was based on the distribution of exposures by industry and by internal rating provided by the firms. In many cases, these ratings were mapped to default probabilities by the firm; in other cases, this association was established by supervisory analysts. This information was confirmed and supplemented by external measures of risk, such as expected default frequencies from third party vendors. Supervisors evaluated firm loss estimates using a Monte Carlo simulation that projected a distribution of losses by examining potential dispersion around central probabilities of default."

A Monte Carlo simulation works by randomly generating inputs going into a model (or formula or equation), and then evaluating all the results. The first step in the process of using a Monte Carlo simulation requires that you create the model. Obviously, that's important. The second part is equally important. It requires you to answer this question: How do you generate the random numbers? To do that, you need to select a "domain" or "distribution". There are many different types of distributions out there: uniform, binomial, triangle, etc. One of the most widely used, and the one that is used in the financial arena more than any other, goes by several different names: Gaussian, normal or bell-curve.

In finance, we typically add a complication, and that is to express movements in terms of logarithms. Personally, I like to keep things simple, so I would hesitate to add anything making it more difficult. But the addition of the logarithm does have a purpose. The reason we express movement in terms of logarithms as opposed to percentages is because a 50% loss and a 50% gain are not necessarily the same thing. Think of a stock at 100. If it loses 50% and then gains 50%, the stock goes from 100 down to 50 up to 75. Instead, a 50% loss and a 100% gain are the equal-magnitude inverse of each other. If the stock goes down 50%, then up 100%, then the path is from 100 down to 50 and back to 100. You get the same result if the path reverses going up 100% first then down 50%. The stock starts at 100, then up to 200, then back down to 100. The net of all of this is that the natural logarithm of 0.50 (-0.69315) is the inverse of the natural logarithm of 2.00 (+0.69315).

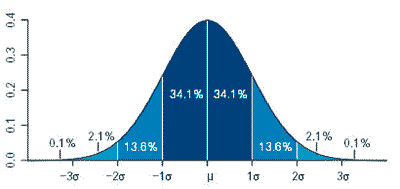

Now back to the bell curve that is used in financial Monte Carlo simulations and derivative pricing. One of the interesting properties of the bell curve is that it gives us the ability to calculate probabilities, as shown in the following graph:

x-axis is expressed in terms of standard deviation. Graph produced using R by Jeremy Kemp

As you can see, there are certain probabilities associated with different standard deviations. That's important, because standard deviation is associated with something else that we as traders are well aware of: volatility. You see, volatility is equal to the annualized standard deviation of the asset.

That means, if we know an asset's volatility, we can use certain formulas to calculate probability.

That's where the ODDS Probability Cone, developed over a decade ago, comes in. This indicator -- unique to MetaStock -- has those formulas built into it, allowing you to easily visualize probability.

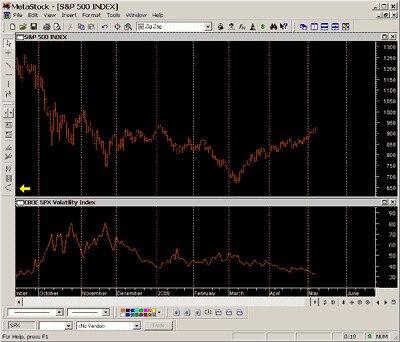

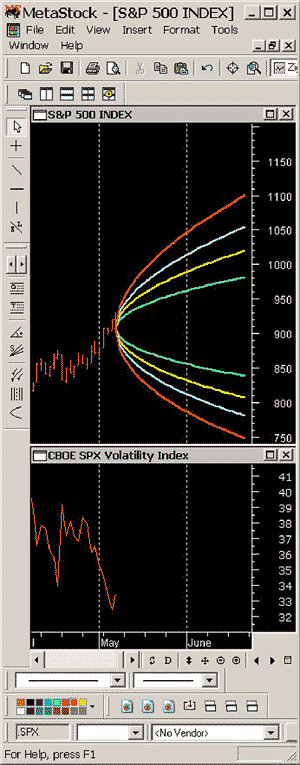

Below is a chart of the S&P 500 Index plotted with the CBOE Volatility Index (VIX). The VIX is a measurement of expected volatility of the S&P 500 Index over the next 30 days. That expectation is implied by the prices of S&P 500 Index options. Also shown in the chart is a yellow arrow pointing to a parabolic shape in the Line Studies toolbar. That's the ODDS Probability Cone.

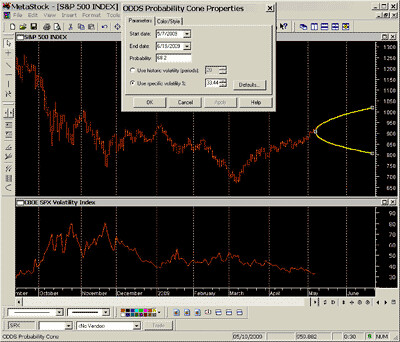

If you click on the parabola, your cursor becomes a cone-shaped indicator that you can move across the chart. Simply move the indicator to where you want to do the , and you're ready to set the parameters, as shown in the next graphic.

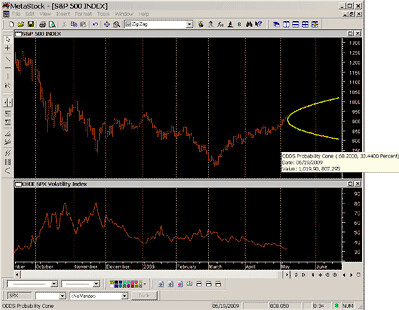

Once you've placed the cone where you want it, simply double click it and see the dialog box that allows you to set the dates, the probability and the volatility. In this particular instance, I set the date from May 7 to the June options expiration, June 19. I set the volatility to the specific value of the VIX that day. And I set the probability to 68.2% -- the level corresponding with +/- 1 standard deviation. Once I've set the parameters, MetaStock performs the calculations I created, and the ODDS Probability Cone (shown in yellow) is drawn. By scrolling across the indicator, you can get the Cone values at different points in time, as shown in the next graph.

As you can see, when the cursor is placed on the Cone at 06/19/2009, the values are 1019.90 and 807.295. That means, based on an expected volatility of 33.44, there is a 68.2% chance that the index will be in between those two values on that date, which is when the June options expire. There is a 31.8% chance the index will be outside that range on June 19.

Not only can we look at 68.2/31.8, the probabilities associated with +/- 1 standard deviation, we can look at other probabilities as well. For example, we can look at 50/50 (green), 80/20 (blue), or 90/10 (orange).

To option traders, this provides vital information, as it allows us to visualize the expected probability of a certain-size market movement. By looking at this chart, we can see that the market is expecting a 90% chance the S&P 500 will be within 750 and 1100 at June options expiration.

So when you look at all that's going on in the banking and the markets today, with the stress tests and the attempts at pricing derivatives, realize that one of the tools those folks are using is built into MetaStock so you too can determine probabilities quickly, easily and visually.

-- Don Fishback

A couple of caveats: First, this is a simplified explanation meant to highlight the major factors and the features of the indicator. A more comprehensive explanation requires a lot more math, and this simply isn't the forum for that discussion. Second, the formulas used to calculate the ODDS Probability Cones are based on the assumption that the stock market follows a logarithmic, normal distribution. No asset actually follows that distribution perfectly. But it is a useful representation when applied to an asset class such as a broad-based stock index. Just remember these words from statistician George Box, "All models are wrong, but some are useful."

ODDS(r) is a registered trademark of Donald M. Fishback, Jr.

About the Author - Don Fishback is the creator of ODDS® – Options and Derivatives Decision Support. ODDS is a method for analyzing options and other derivatives based on a unique method for balancing risk, reward and probability. The key to this approach is volatility, which is the way most people look at options, plus magnitude over time. Don’s oddsonline.com software provides traders with his unique Measure, Don’t Model™ tools. Not only does ODDS Online calculate probabilities based on the most commonly used option pricing models, but it also incorporates actual measurements of stock price movement to evaluate option strategies. A 25 year veteran of the derivatives business, Don spent many years on the conference and lecture circuit. Now he prefers to spend his time at home with his family.

Back to top

Support Tip

How can I restore the back-up copy of my custom formulas?

Contributed by Equis Support

How can I restore the back-up copy of my custom formulas?

Open MetaStock

Click Tools | Indicator Builder

Click Organizer

Select "Import formula files", then click Next

Specify the location you wish to import the files from

Click Finish

All of the formula files, experts, explorations, and system tests will be read from and added to the current installation location for MetaStock.

If you already have formulas, experts, explorations, and system tests of the same name in MetaStock, you will be asked if you want to replace them. If you say yes, the import will finish, overwriting the formulas of the same name. If you say no, the import will be halted and no custom formulas will be restored.

Back to top

MetaStock Features

Fire Plug-In

Contributed by Ken Spelman

One of our best plug-ins for broad market is also one of the least understood; Fire. Fire is a tool that allows you to calculate and plot breadth indicators on sectors and industry groups rather than the market as a whole. A breadth indicator is a specific type of indicator using advancing and declining issues to determine the amount of participation in the movement of the stock market.

Fire allows you to perform External Relative Strength (also known as ERSA). ERSA is a concept that measures how a stock’s price has performed versus all other stocks in the selected group over a specific time frame. Fire allows you to customize your by choosing the stocks you group together to calculate an array of breadth indicators over any time period. You can then plot your results in MetaStock for more .

Fire is the only program that will allow you to easily create your own custom index. With Fire’s custom indices tool, you’ll get quick calculations on the average open, high, low and close of all the securities in the folder you create.Last edited by tradingpro8x; 18-09-2012 at 08:35 AM.

-

12-09-2012 05:34 PM #7

Senior Member

- Ngày tham gia

- Aug 2010

- Bài viết

- 648

- Được cám ơn 325 lần trong 218 bài gởi

Những series bài hay về phần mềm PTKT phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm PTKT phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm PTKT phân tích kỹ thuật MetaStock

The Downtrend and Uptrend are Not Created Equal

Contributed by Martha Stokes, C.M.T.

There are many myths perpetuated in the trading world. One such myth is that if you know how to trade the uptrend or the buy side of the market, then you can easily switch and trade the downtrend or sell side of the market. All too often, Retail Traders assume the two are mirror images of each other. Unfortunately, this often leads to problems for traders who want to sell short.

The downtrend is significantly different in price action than the uptrending market. Here are some aspects of downtrending price action every trader needs to understand and recognize to improve their sell side trading:

The Market Participants who trade the downtrending market are a different mix than those who trade the uptrending market and do so for very different reasons. Since the late 1990’s, the levels of Market Participants have expanded and we now have 8 groups of Market Participants each with their own agenda for investing or trading stocks. On the uptrend, the Institutional Investor dominates price action. During a downtrend, the Institutional Trader controls the action. Since each of these groups has entirely different buying and selling agendas, price action is impacted often in dramatic ways. Understanding this phenomenon helps the Retail Trader know what kinds of entry signals to look for, the patterns to watch for in institutional indicators, and what kinds of exit signals and strategies to use for both stock and option trading.

Stocks require strong volume patterns to move up, so a continued increase in volume is necessary for the uptrend to sustain. On the downtrend, stocks can and do fall even on low volume patterns. This is especially true during the secondary and final phases of the downtrend. Retail Traders need to adjust their volume indicator settings to accommodate the variances between the uptrend and the downtrend. Volume bars should be used with a sub-indicator, either a moving average or rate of change and the settings need to be significantly tighter on the downside to achieve an accurate of volume to the downside.

To the downside, the angle of descent is far more vertical and occurs more frequently than the angle of ascent. The angle of descent can maintain a vertical drop longer than the angle of ascent. When a trader understands this phenomenon and is expecting it, then they are able to make adjustments to their exit strategies and indicator to keep them in the trade for higher point gains. Since the angle of descent is steeper, the sell side tends to move faster with far more momentum, even on lower volume. This creates different Trendline Patterns to the downside. Traders should expect to see tighter consolidations with dramatic stairstep patterns that are longer than upside stairstep patterns. The runaway trendline pattern will also occur more often to the downside than to the upside.

Traditional textbook theory on bear market trends identifies 3 phases of a bear market; however, today’s bear markets tend to have more than 3 phases. Bottoming patterns are more complex and gaps are more common. Retail Traders also need to watch out for more frequent bounces. During the first phase of a bear market or major correction, price action will be at its steepest. In recent years, the final move down of major corrections tends to fizzle out rather than the huge dramatic drops that occurred in prior decades.

The initial downtrend phase is an important area for retail traders to recognize to enter just as the topping action completes. Often Retail Traders are not aware of the topping action and miss the highest point potential of the downtrend. Conversely, during the early stages of a market bottom, Retail Traders are often attempting to sell short while institutional investors are quietly accumulating.

Here are a few tips to help you with your selling short trading:

Whenever any financial market, whether it is stocks, bonds, options, or forex go vertical and sentiment has gone over 90% to the upside, start watching for one of the 5 topping patterns and shift your mindset in preparation for selling short. Choose 1-3 sell short entry signals, adjust your indicators, and start setting up for selling short. Wait for the drop in volume on the final move up.

The Institutional Investors tend to exit the stock, index, or other instrument prior to the final move up. The small investor and late comers create that vertical extreme peak pattern on falling volume. If the stock, index, or other instrument doesn’t make a higher high and higher low on rising volume, then you have an initial topping pattern developing. Be aware that the late buyers coming in will “buy on the dip” with ‘market orders’ rather than controlled orders and this can cause a big bounce. Watch for this pattern.

Do not keep your stop loss too tight, allow for normal overlapping that forms in downtrend price action. Falling price action tends to overlap far more than upside price. If you keep a very tight stop, you will get whipsawed out of the sell short or option put prior to the major move down. Overlapping on downtrending stocks occurs because even as the Institutional Traders move in to control the downside action, late uninformed small lot buyers are rushing to buy with ‘at market’ orders. This creates a surge of pre-market orders allowing market makers to gap price up at market open, then as the large lot sellers move in, price drops quickly. The more popular the stock, the more overlapping of price action there will be when small lot late buyers meet Institutional Traders selling short.

When a stock drops below $15.00, it has less profit potential for selling short. Retail Traders need to be vigilant during the final phases of a downtrend to monitor the activity of the Institutional Investors who will move in quietly without disturbing price much. Once their counterparts, the Institutional Trader, finds out about the quiet accumulation, speculative bottoming action will occur. Often times Retail Traders have delayed selling short during a downtrend and jump in just as the stock is about to begin a bottom. If a stock has fallen 40%-50% or more, then it is usually not an ideal candidate for selling short.

Keep a 3/1 Profit Point to Risk ratio when selling short. The sell side offers a much higher profit potential per trade than the buy side, however, the risk is also greater as bounces can wipe out profits quickly. By choosing only optimal picks with a higher profit to risk ratio, you lower your overall risk and raise your profit potential.

Do not choose weaker picks with lower profit to risk ratios simply to have something to trade. If you can’t find ideal picks, then stop and accept the fact that the market is telling you something important. Often when you aren’t able to find picks with good profit to risk ratios the market is right on the cusp of a major upside shift.

Summary: The sell side is different than the buy side of the market. It has a much faster moving price action in the early stages of the downtrend, but it also has overlapping patterns not seen as frequently when stocks are trending up. The matrix of Market Participants—who is buying, who is selling, who is buying to cover, and who is selling short differs on the sell side to the buy side and impacts price action. When a trader understands these often subtle differences and can see the patterns on the price chart, they are on their way to mastering the sell side and becoming an expert trader.

About the Author:

Martha Stokes, C.M.T. is the co-founder and CEO of TechniTrader®, an educational firm dedicated to helping small investors and retail traders. Since 1998, TechniTrader® has taught thousands of beginners to professional level traders how to be consistently successful in the stock and option markets.

Martha’s fascination with the markets and business started at the age of nine. She made her first investment while still a teen. Her theory on Cycle Evolution is a landmark work on financial cycles. She has been involved in several startups and has sat on both sides of the Venture Capital negotiating table, worked on an IPO, managed a small fund, taught at community colleges, and has been a guest speaker at numerous seminars and investment groups including the Boeing Employees Investment Group. She has been a guest on the CFRA radio Ottawa Canada.

Her long list of educational work includes: 15 stock, investing, and option courses, 16 semester length Lab Classes, her Annual New Technology Reports, Sector and Industry, and Special Edition Reports, hundreds of articles, resource papers, and white papers. Martha writes 6 newsletters each week and still finds time to answer student questions.

www.technitrader.com

www.marthastokes.com

www.technitraderblog.com

TechniTrader Twitter Page

TechniTrader Facebook Page

Back to top

Support Tip

Updating Your Symbol Utility - Symbol Database

Contributed by Equis Support

The stock market is dynamic and symbols are constantly being changed, removed, or created. In order to keep up with the symbol changes, Equis updates the symbol file found within its symbol database. The Symbol Utility reflects those changes. It allows customers to automatically update the symbols in their “Local Data” view in the Open dialog on a monthly basis without having to manually change each symbol within each folder on their hard drive.

How to update the Symbol Database built into MetaStock.

Open MetaStock.

Select Tools – “Update Symbol Database”.

When you get the message “patch successful” select Close.

Close and restart MetaStock.

How to install the Symbol Utility for Reuters DataLink.

Go to: http://www.equis.com/customer/suppor...olutility.aspx

Read the warnings and agree to the terms and select “Download RDL file”.

When prompted select “Save”, this will open the “Save As” window. Using the drop down menu select the “Desktop” for the “Save In” then select “Save”.

When the download is complete close out of the Symbol Utility web page.

On your desktop you will have a new icon named “RDL_Symbol_Utility.exe” double click onto the file and select “Run”.

The extractor window will appear showing the unzip folder path as C:\MetaStock Data, next select “Unzip” to begin the extraction process.

Follow the steps below to download historical data from Reuters DataLink.

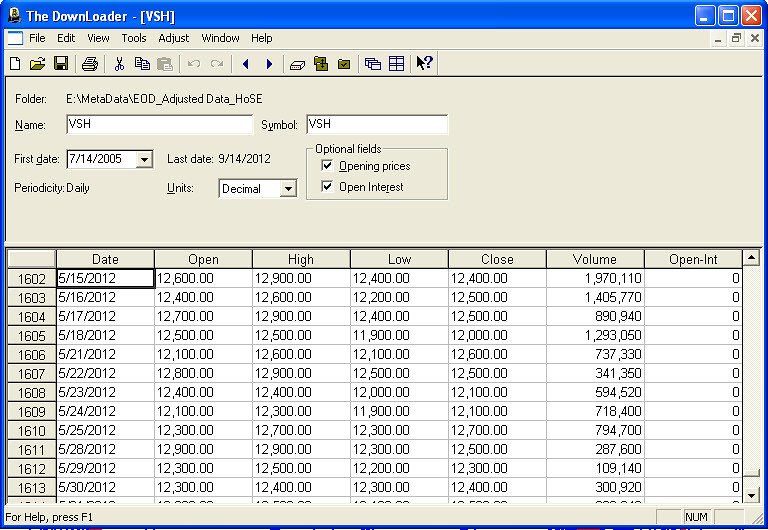

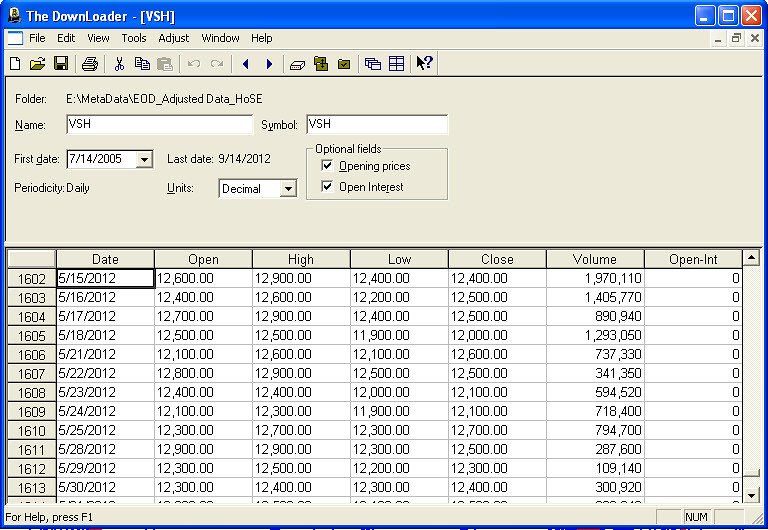

Open the DownLoader.

From the Tools menu in The DownLoader select “Download Prices”.

This will open the Select Securities window. On the left hand side of the folder tree, expand the C drive and highlight the MetaStock Data folder and select “Add all Subfolders” and select OK. This will add the folders and symbols created by the Reuters DataLink Symbol Utility for a data download.

Select “OK” on the Select Securities window and the Vendor Selection window opens. Make sure the Reuters DataLink tab is forward in front and select OK to begin a data download.

Back to top

MetaStock Features

The ETS Trading System

Contributed by Greg Allred

In today’s marketplace, there is a lot of confusion and bad trades being executed. The common systems and methods used in past years do not seem to work as well in today’s market conditions. ETS Trading System can create clarity in today’s uncertain market conditions and help shift the odds in your favor.

ETS Trading System does an excellent job of providing very clear and easy to read buy and sell signals. The system will display protective stops, trailing stops, and profit targets. Many systems only work on an end-of-day or intraday basis but this system works well for both time frames. ETS Trading System has two experts: ETS Basic and ETS Complex. The complex expert includes profit targets and protective stops for long or short trades. This system works with stocks, options, indices, futures, and FOREX. ETS Basic gives you clear and precise buy and sell signals.

The powerful tools ETS offers helps you eliminate the stress and emotion most people experience while trading. Whether you are a new or experienced trader, ETS can help avoid costly decisions and mistakes. The program comes ready to use out of the box and is easy to use. Help put your trading on the right side of the markets by adding these valuable tools to your collection.Last edited by tradingpro8x; 18-09-2012 at 08:35 AM.

-

13-09-2012 09:16 AM #8

Senior Member

- Ngày tham gia

- Aug 2010

- Bài viết

- 648

- Được cám ơn 325 lần trong 218 bài gởi

Những series bài hay về phần mềm PTKT phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm PTKT phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm PTKT phân tích kỹ thuật MetaStock

Creating an Effective System: Acceleration Bands and Williams' Percent R

Contributed by Price Headley

For option traders, correctly forecasting short-term price action is imperative to long-term success and, in my view, technical is the best way to achieve this. Many would say the “Holy Grail” of technical is to find true “leading” indicators … those that point to directional movements and trends as they are occurring or before they occur, not lagging indicators that show what has already occurred. I’ve tested and designed hundreds of technical indicators over the years, and I want to share with you one of my trading systems that uses two of my favorite and time-tested indictors. The two indicators? One is Acceleration Bands, which I created. The other is Williams’ Percent R, which I have modified and created specific rules to utilize that are different than is seen in normal trading systems.

A major problem that many traders have is too many signals. In other words, their criteria needs to be tightened and refined. As many of you already know, I look for the Big Trends that rarely occur, this helps me leverage my capital while reducing the number of total trades. Now, don’t be fooled, there is no fool-proof system out there … so risk control is an important part of any technical system. In life, it's good to be an optimist, but excessive optimism in system development can easily lead to ignoring the risks and the weaknesses in your trading system. All systems have weaknesses. Make sure your systems have a risk control element to it.

Today I want to share with you a system that uses only two indicators, Acceleration Bands and Williams’ Percent R – remember keep your system simple. First, it’s important to describe each system independently to see the strength and weaknesses of each.

Acceleration Bands: Available in the MetaStock Big Trends ToolKit

Description: Adaptive bands that contain 95% of price action usually used in 20 or 80 bar periods. Trading signals occur when price action is confirmed outside the bands. This indicator targets the top 5% of moves, keeping traders focused on the best trends.

The 20 Bar Acceleration Band Expert Advisor (SPX chart below) shows buy and sell signals based on my system. Notice that in the 14 months shown, the S&P500 only exposed a signal 4 times, each was profitable. This depicts the 5% theory well – Acceleration Bands highlight only the extreme moves for option traders. The issue many traders face is really two-fold; many traders want more signals and the entry point can use some refinement. Like the Yin & Yang relationship, I’ve developed a system that combines Acceleration Bands with Williams’ Percent R to remove any weaknesses and refine trading signals. Let’s take a look at how it works.

Williams’ Percent R – Traditional indicator available in MetaStock. The Big Trends Willams’ %R is available in the Big Trends Toolkit with two separate systems based on breakout and retest (lower risk entries) methods. We have smoothed out and modified Williams’ Percent R to make it a better and more usable trading vehicle.

Descriptions: Larry Williams created the Percent Range oscillator to highlight overbought versus oversold levels in securities. Traditionally overbought connotates a long exit or sell short entry as oversold would insinuate the opposite, however, we in general consider overbought to be bullish and oversold to be bearish. The Big Trends Percent R system targets the top 20th percentile and bottom 20th percentile.

In the chart below we have the Expert Advisor for Big Trends ToolKit (BTTK) Percent R Retest System applied to the S&P500. My first impression is that there may be too many signals with 11 trades in 14 months (compared to 4 with the Acceleration Bands). The Percent R Retest System targets lower risk entry points by signaling buy or sell-short signals after a corresponding breakout confirmation occurs. These pullbacks, or retests, are patterns that help identify fast moving trades that are immediately profitable. If they do not move in the expected direction immediately an exit signal is triggered for effective risk control.

Notice that we also have 20 Bar Acceleration Bands applied to the price action -- my favorite system employs both Percent R and Acceleration Bands; reducing the number of trades while only trading the best pullbacks. I focus on Percent R retests within Acceleration Band signals. Let’s take a look at an example of this signal below.

Notice above that we also have 20 Bar Acceleration Bands applied to the chart (but not a part of the trading signals) -- my system employs both Percent R and Acceleration Bands; reducing the number of trades while only trading the best pullbacks. I focus on Percent R retests within Acceleration Band signals. Let’s take a look at an example of this signal below.

When developing a system I look for winners that are at least twice the size of losses and a minimum 50% winning average, however, I’ve found that 60% winning average is optimum and realistic. That’s why using Acceleration Bands and Willams’ Percent R has become one of my favorite two indicator systems. Acceleration Bands highlight extremely strong moves, while Percent R Retest Method highlights low risk entry points within those Accelerations. In addition, I found that this system works particularly well on individual stocks, which typically provide more Acceleration signals than market averages like the S&P500.

For ease of learning I want to show you a quick example of a signal using both indicators within the same time frame as the charts above on the S&P500. In the chart below we have the Acceleration Band Expert Advisor (20 Bar) exposing a sell-short signal based on momentum. Notice that in the days after extreme selling signals an Acceleration short signal, we see a bounce, or retest, in price action. This typically occurs from value seekers, however, we know that once the trend has Accelerated thus far it’s probable to continue.

The blue arrow shows us where Percent R initially confirms bearish activity (prior to Acceleration signal) , and we know that any Percent R spike above 20% is now a qualified retest. Furthermore, if the retest occurs after the Acceleration Band signal it’s a lower risk entry within a highly probable signal. Adding the Percent Retest filter to your Acceleration bands will help you be patient for those lower risk entries after momentum has confirmed; while Acceleration signals help you identify weaker trends where retest become reversal.

As I’ve mentioned, in general keep a trading system simple – I have found that the unique combination of Acceleration Band breakouts and Williams Percent R re-tests (utilizing Big Trend Percent R methods) is a very effective trading tool & system. I encourage you to start testing this on your favorite stocks as it has helped me increase my winning percentage, while reducing those whipsaws that many traders experience from Acceleration Bands alone.

Trade Well,

Price Headley

BigTrends.com

1-800-244-8736

Back to top

Support Tip

How do I color my volume for up / down colors?

Contributed by Equis Support

Volume is one of the most powerful technical tools traders use in predicting the way a security is about to move. The difference between a smaller return and a bigger return is sometimes only a matter of seconds. Coloring volume bars to identify up volume and down volume can be used as a tool to give traders the edge they need.

To do this we must create a custom indicator in MetaStock.

1. Open MetaStock.

2. From the Tools menu on the main toolbar, select Indicator Builder.

3. Click New on the right hand side to open the Indicator Editor to create the new indicator.

4. Type in the desired name of the indicator in the name section.

5. Check the option to “Display in quicklist”.

6. Click in the larger “Formula” window and type or copy and paste this formula:

When comparing volume data to yesterday’s volume data:

If(V>=ref(V,-1),V,0);

If(VOr when comparing volume data to yesterday’s close price:

If(C>=ref(C,-1),V,0);

If(C7. Click ok to close the Indicator Editor and create the indicator, then close the Indicator Builder dialog.

8. Open any chart.

9. Using the indicator quick list, plot your new volume indicator; this will plot two different lines.

10. Scroll to the end of the chart and right click onto the line going up and select properties. Next select the Color/Style tab and select green for the color and set the style to histogram. Then select OK.

11. Scroll to the end of the chart and right click onto the line going down and select properties. Next select the Color/Style tab and select red for the color and set the style to histogram. Then select OK.

Back to top

MetaStock Features

Big Trends Toolkit Review

Contributed by David Derricott

The Big Trends Toolkit has been an immensely popular add-on. The reason is simple; people have found that the system works. Big Trends Toolkit features Explorations, System Tests, and Expert Advisors. The systems included in the add-on are Price Headley’s time tested strategies and can be used in any market. When market changes happen, as they have in the last year, it is important to have strategies that have proven their merit over time, and this is why the toolkit has been so popular. The Toolkit can be used to identify low-risk entry and exit points, spot accelerations, and more. I would encourage users to use the System Tests included with the Big Trends Toolkit to identify the best system to match the stocks you are trading. Customers really appreciate the level of detail in which the commentaries define how to use the system in trading. Each commentary provides detailed explanations of the systems and detailed instructions on how to trade each entry with your risk tolerance in mind. You have the opportunity to try this add-on on a 30 day money back guarantee.Last edited by tradingpro8x; 18-09-2012 at 08:35 AM.

-

Những thành viên sau đã cám ơn :

ziming (11-12-2013)

-

13-09-2012 09:37 AM #9

Gold Member

- Ngày tham gia

- Oct 2009

- Bài viết

- 1,925

- Được cám ơn 617 lần trong 428 bài gởi

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm phân tích kỹ thuật MetaStock

Catch that Trend! Directional Strength and How to Find it.

Contributed by Barbara Star, Ph.D.

Traders usually favor moving averages to help them determine price trend. However two other popular indicators, the Moving Average Convergence/Divergence (MACD) and the Average Directional Index (ADX), can help traders detect not only trend direction, but trend strength as well.

The MACD, created by Gerald Appel, is a momentum indicator that often identifies price direction as it rises and falls above or below its trigger line and its zero line.

The ADX, part of the Directional Movement system developed by Wells Wilder, is designed to detect the strength of price movement. ADX values in the 20 to 30 range indicate mild to moderate trending behavior while values above 30 usually signify a strong trend. A rising ADX indicates that prices are trending, but does not reveal the direction of that trend.

Plot the ADX 14 period indicator above the MACD on the same price chart as shown in Figure 1, and patterns emerge that show both trend strength and trend direction.

Three Patterns

Three distinct, and profitable, patterns frequently appear. These patterns do not detect tops and bottoms, but can help traders confirm a trend. They are especially useful for those traders who prefer shorter-term trades.

Confirming Pattern: The confirming pattern occurs when both the ADX and the MACD rise and fall in unison with price. When the indicators rise together they identify up-trending price movement that presents bullish traders with an opportunity to enter the long side of the trade. The strongest and most ideal trading configuration takes place when the ADX begins to rise and the MACD rises above its trigger line and also above its zero line. The level from which the ADX rises does not matter. In the Confirming pattern, when prices change direction to the downside so do both the ADX and MACD to indicate a loss of momentum and/or a potential trend change.

The Confirming pattern was evident on the daily Allegheny Technology price chart. Both indicators rose in April confirming the price move from the $30 to $40 level. Both indicators declined in May as prices dipped, but rose once more in June when price moved toward $45. The indicators declined in late June to reflect the falling to sideways price action.

Diverging Pattern: The diverging pattern identifies down-trending price movement. Here, the indicators move in opposite directions. The ADX rises to indicate that it has found a trend, but the MACD declines which indicates that the direction of the developing trend is down. Its mirror-image formation makes it an easy pattern to spot visually.

This is a good pattern to follow for traders who are bearish and want to short a stock. It also serves to warn those traders who might wish to enter a long position that they should wait for a more favorable time.

The strongest pattern occurs when the ADX rises while the MACD falls below its trigger line and also below its zero line. Two distinct Diverging patterns appeared on the chart of Abbott Labs in Figure 3 as prices took a nosedive from February to March and again in April.

Converging Pattern: This pattern has an upward bias that comes after a steep decline. The ADX rolls over and begins to decline, signifying that the strength of the trend has weakened. At the same time the MACD, which had been below its zero line, begins heading up to its zero line. Visually, the declining ADX and the rising MACD seem to be converging toward each other. Although this pattern sometimes marks the beginning of a new up trend, more often than not it is a countertrend rally that produces a partial retracement of the price decline.

Figure 4 shows the Converging pattern on a daily chart of Honeywell International. Following the price decline in the February time period that took the stock below the $25 level, price began moving up in March where it was able to retrace much of its loss. The MACD responded to the increase in price by crossing above its trigger line and rising to (and in this case, through) its zero line as the ADX stopped rising and moved down to complete the Converging pattern.

This is an enticing pattern, but often not as profitable as the others because its moves tend to be short-lived and, even though the MACD rises, prices may move sideways instead of upward.

A Trading Example

Traders could have profited from many of the patterns signaled by the ADX-MACD duo on the CH Robinson Worldwide price chart in Figure 5.

Area A marked a decline with a Diverging pattern that was followed by a Converging pattern as price rose in area B. That Converging pattern gave way to a Confirming pattern (Area C) as price continued to rally another ten points. A new Confirming pattern appeared in Area D which reflected the decline that filled a prior price gap before reversing to the upside.

Could you have benefited from any of the four areas identified by the ADX-MACD patterns?

Summary

The patterns displayed by the ADX and MACD combination appear on charts of commodities, indexes, and mutual funds as well as stocks. Not only do the patterns have profit potential, they signal changes in price which can help avoid trading pitfalls. This dynamic duo may be worth adding to your trading arsenal.

About Barbara Star

Barbara Star, Ph.D., (818) 224-4070, is a former vice-president of the Market Analysts of Southern California. She is a frequent contributor to the magazine, Technical of Stocks and Commodities. A former university professor, Dr. Star currently provides individual instruction and consultation to those interested in learning technical . Her e-mail address is star4070@aol.com

Back to top

Support Tip

How to Automatically Load Your MetaStock Charts at Start-up

Contributed by Equis Support

Any trader can tell you that being able to quickly load your workspace makes decision making easier and faster. With the ever changing markets, seconds can mean the difference between making a profit and taking a loss. MetaStock's "Restore workspace on startup" allows users to automatically load a user defined workspace of charts and trading systems when opening MetaStock.

How do I get MetaStock to automatically open my charts?

1. Open MetaStock

2. Select - Tools - Options

3. Select the General tab - check the option "Restore workspace on startup".

4. Click OK to apply the settings.

5. Next open all the charts you would like to open automatically on startup, then select File - Exit to close the MetaStock program.

6. When you re-open the program it will open those charts.

Back to top

MetaStock Features

JBL Risk Manager v7.0

Contributed by Devin Ekberg

As I interview successful traders from all over the world, I have the fortune of learning what works and what doesn't work. Overwhelmingly, successful traders share common principles in their individual strategies even though they trade and invest in different markets around the world. Simply stated, there are four requirements:

Entry Strategy - Education & Experience

Trade Sizing Strategy - Money Management - How many shares to buy.

Exit Strategy - Risk Management - Minimize Loss with a stops or exits.

Profit Taking Strategy - Protecting Profits on the way up, when do I SELL

Unfortunately, the major focus of many technical traders is to create a system of entry and exit rules, and trying to develop discipline to follow them. However, they ignore the critical concept of money risk management, and endanger their long-term survival.

There are many books available on proper risk and trade management, and learning these principles are important for removing emotion and calculating risks. The subject is sometimes a bit difficult to follow and ultimately difficult to put into practice.

The new JBL Risk Manager v7 software from Metastock gives a simple "step-by-step" method of managing your trades. It gives you Automatic Trade/Position Sizing, Initial Stop and Trailing Stop exit price calculations, Multiple Portfolios, Short & Long trades, integrates with your Metastock database, Stock Split Adjustment, Performance: Win/Loss ratios, and Trade Expectancy.

This add-on is very unique among the Metastock add-on and plug-in library. If you are currently trading and not utilizing a money management tool, I strongly encourage you to add this to your to-do list. It will make a huge difference.

-

13-09-2012 03:41 PM #10

Gold Member

- Ngày tham gia

- Oct 2009

- Bài viết

- 1,925

- Được cám ơn 617 lần trong 428 bài gởi

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm phân tích kỹ thuật MetaStock

$34 Soybeans...Fantasy or Possibility?

Contributed by Jake Bernstein

If you think that my headline is a clear indication that I have finally lost my marbles then perhaps you may change your mind when you consider this possibility in the context of history. Specifically I refer to the 1970’s experience in the soybean (and many other) markets. Given the confluence of cycles, COT commercials accumulation, central bank massive money printing and timing indicators, I believe that the stage is being set for a 1970’s style commodity price inflation “blow off”. Gold and silver have led the way. While it is likely that gold and silver have not yet made their highs, the odds are growing daily that many if not all of the other commodity markets will make similarly large gains over the next few years. I discussed the details of my expectation in a 2 hour Webinar which you should attend if you have not already done so. It was one of my most detailed Webinars and while I made some stunning forecasts for the next few years I believe that they are reasonable as well as based on facts and not fictions.

Among my forecasts was the realistic possibility that soybean prices could reach the $34 level over the next few years. While producers may rejoice and perhaps even see that this is possible based on fundamentals, many traders will likely consider this forecast to be “off the wall” or just not possible. Before you dismiss my forecast as unrealistic, I urge you to consider the chart below. It shows the 1970’s bull market in soybean futures – a bull market that developed in underlying economic and cyclical conditions that were, if anything, less extreme than what exists today. Now, after reviewing the chart, consider the current chart for soybeans with a similar % increase projection. What do you see?

Now that you have had a look at the soybean bull market of the 1970’s consider the “what if” scenario with regard to the current soybean market. Buy why do so? Here is the logic:

Soybean cycles are long term bullish

Fiat money printing all over the world has made virtually all paper backed currencies unpalatable forcing many professionals and savvy investors into tangible assets

Demand for grains and feeds continues to be strong

Based on the monetary and fiscal policies that have been rushed into place in order to prevent an economic collapse, the odds favor significant commodity price inflation for the next few years and

Precious metals accumulation continues to underscore a flight from paper currency into hard assets. This trend has started to spread to all tangible commodities

If soybean prices repeat their 1970’s experience then the chart below shows what could happen over the next few years. Is it impossible? Before you say that this can’t happen consider all of the “this can’t happen” events of the last 25 years. Now take a look at the chart again. I realize that I’m going out on a limb with my forecast but many of my cyclical forecasts over the years have been correct.

Now add to the mix the fact that Commercials as assessed by the Weekly Commitment of Traders Report using my analytical method (available in the Jake Bernstein MetaStock Plug In) shows strong accumulation of long positions virtually across the board in many of the grain markets. Time will tell If I am right but the confluence of fundamentals and technicals is noteworthy. In light of the recent grain report which resulted in a collapse of grain and soybean prices some of you may not take my forecast seriously. If, however, you see my logic this may be the decline that leads to the buying opportunity of great importance. Would I “catch the falling knife” by entering now? No! I’d wait for my intermediate term timing triggers to turn bullish (also available in the Jake Bernstein MetaStock Plug In).

Back to top

Support Tip

How can I scroll through a MetaStock chart one bar at a time?

Contributed by Equis Support

Metastock Pro & MetaStock EOD: 6.52 – 11

Open the desired chart in MetaStock.

Hold down the "Shift" key on the keyboard.

While you are holding down the "Shift" key, left click once on the right or left arrow of the scroll bar of the open MetaStock chart. This will only move one bar to the left or right.

Back to top

MetaStock Features

Performance Systems Plus

Contributed by Ken Spelman

MetaStock (7.2 or newer) comes with 26 performance trading systems. Now you can complete the package and add fifty-four new performance systems and seventy new explorations. The makers of Performance Systems Plus tested thousands of trading systems on thousands of securities to develop this select group of systems. Performance Systems Plus will have you trading with a higher level of confidence and expertise than you’ve ever had before. It includes state-of-the art performance tools for ten of these systems to create a trading strategy helping take the guesswork out of your trading and maximizing your profits.

Performance Systems Plus is optimized for swing and position trading. It is not designed to be used with day-trading. This is one of our easiest add-ons to use and works well with commodities or stocks from any market worldwide.

With Performance Systems Plus you can:

Run an all-new type of exploration that performs system tests over an entire database of securities to find those securities with the most profit potential.

Generate daily buy and sell signals and alerts.

Run a comparison test to find out which of the fifty-four trading systems works best for your chosen security.

Run a signal exploration on a chosen system to generate a list of stocks with buy and sell signals for that day.

With Performance Systems Plus you get:

Find out why Performance Systems Plus has been one of the top MetaStock add-ons of all time.

-

13-09-2012 04:08 PM #11

Gold Member

- Ngày tham gia

- Oct 2009

- Bài viết

- 1,925

- Được cám ơn 617 lần trong 428 bài gởi

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Những series bài hay về phần mềm phân tích kỹ thuật MetaStock

Đây là series những bài nghiên cứu chuyên sâu về phần mềm phân tích kỹ thuật MetaStock

Money Flow Index

Contributed by Steven B. Achelis

Overview

The Money Flow Index ("MFI") is a momentum indicator that measures the strength of money flowing in and out of a security. It is related to the Relative Strength Index, but where the RSI only incorporates prices, the Money Flow Index accounts for volume.

Interpretation

The interpretation of the Money Flow Index is as follows:

Look for divergence between the indicator and the price action. If the price trends higher and the MFI trends lower (or vice versa), a reversal may be imminent.

Look for market tops to occur when the MFI is above 80. Look for market bottoms to occur when the MFI is below 20.

Example

The following chart shows Intel and its 14-day Money Flow Index.

Divergences at points "A" and "B" provided leading indications of the reversals that followed.

Calculation

The Money Flow Index requires a series of calculations. First, the period's Typical Price is calculated.

Next, Money Flow (not the Money Flow Index) is calculated by multiplying the period's Typical Price by the volume.

If today's Typical Price is greater than yesterday's Typical Price, it is considered Positive Money Flow. If today's price is less, it is considered Negative Money Flow. Positive Money Flow is the sum of the Positive Money over the specified number of periods. Negative Money Flow is the sum of the Negative Money over the specified number of periods.

The Money Ratio is then calculated by dividing the Positive Money Flow by the Negative Money Flow.

Finally, the Money Flow Index is calculated using the Money Ratio.

*Excerpt taken from Technical from A to Z by Steven B. Achelis. The Money Flow Index is available in MetaStock 11.

Back to top

Support Tip